The roadside bhaiya selling sunglasses and umbrellas around my street lives by this lesson fully.

On surface, he sells seemingly unrelated products but a closer look at his business sense makes me wonder. He knows that when it’s raining, it is easier to sell umbrellas and on a sunny day, customers demand sunglasses. With both items to sell, his product line is varied enough to reduce the risk of losing money during any season. Smart, isn’t it?

That’s exactly the same thumb rule you should apply to your portfolio. Catchphrase here is Allocate and Diversify Correctly.

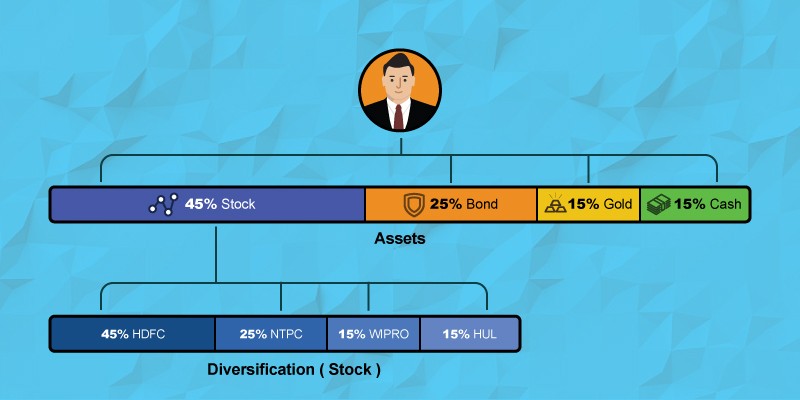

Asset Allocation is the way of spreading investments in your portfolio among different asset categories like stocks, bonds, mutual funds etc. This mix of assets is determined by various factors like your preferences, time horizon and ability to tolerate risk.

But a well-planned asset allocation doesn’t always translate to appropriate diversification.

You might have correctly chosen to have 45% stocks in your portfolio but does that mean you can invest in one stock? No, you cannot bulk the investment in one asset category and that’s where the role of diversification comes in. Diversifying among various stock categories would ensure a winning portfolio.

Wondering how it impacts your investments?

Ramesh and Asha both decided to invest 10 lakhs each. Unfortunately, they had to face the heat of major fall in the market during 2008 where equity declined by 51.84%.

Ramesh chose to invest in just equity and did not think about spreading out his investment. So when equity declined by 51.84% in 2008, the value of his portfolio stood at Rs.4,81,600. He lost more than half of his original portfolio value.

On the other hand, his friend Asha invested 70% of her money which is 7 lakhs in equity and parked remaining 3 lakhs in fixed deposit. Despite a decline of 51.84% in equity, 7% interest on fixed deposits helped offset her loss.

When the value of equity declined to Rs.3,37,120, the value of fixed deposits stood to Rs.3,21,000. Thus, her overall portfolio value stood at Rs.6,58,120 in comparison to Rs.4,81,600 of Ramesh who chose to stick to one asset class. It is always better to spread out your investment in 2 to 3 asset classes.

So what’s the learning?

Keep your sunglasses and umbrella together to sail through untimely weather changes!

Right asset allocation is the first step to correctly position your portfolio on the risk-return game. And diversification is the key to mitigate the risk of your portfolio suffering as a whole.

Devise both strategies smartly to ensure lesser volatility in your portfolio and to get a step closer to your investment goals.