The Insurance Regulatory and Development Authority of India (IRDAI) has issued an order notifying the revised premium rates for Motor Third Party (TP) Liability for the current financial year, i.e. 2019-20. The order comes into effect from 16th June, 2019.

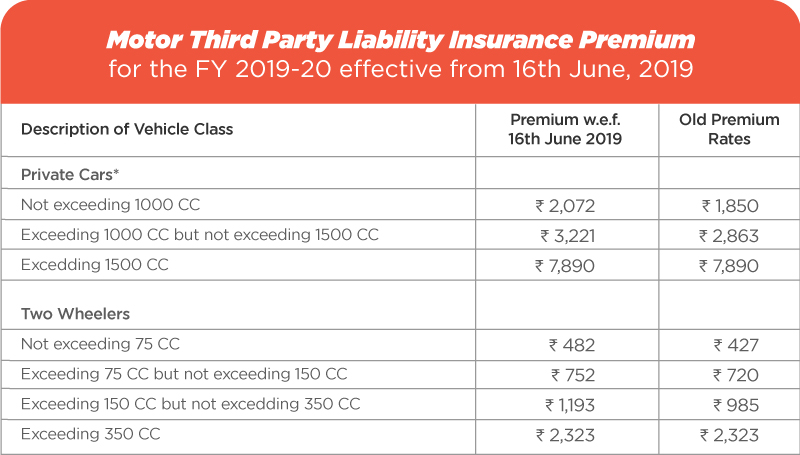

Please find attached the revised rates for Private Car and Two-wheeler

For Private cars not exceeding 1000 cc, the annual TP premium has been raised from Rs 1,850/- to Rs 2072/-, and for private cars exceeding 1000 cc but not exceeding 1500 cc the premium is raised from Rs.2,863 to Rs. 3,221 which is approximately 12.50% increase over previous rates. However, the TP premium for private cars exceeding 1500 cc will remain unchanged at Rs.7, 890/-

Whereas, For Two-wheelers not exceeding 75 cc the premium is raised from Rs 427/- to Rs 482/-, for Two-wheelers exceeding 75 cc but not exceeding 150 cc the premium is raised from Rs 720/- to Rs 752/-, and for Two-wheelers exceeding 150 cc but not exceeding 350 cc the premium will go up from Rs 985/- to Rs 1,193/- which is around 21% increase. However, for all Two-wheelers exceeding 350 cc, the premium will remain the same, i.e. Rs 2,323/-.

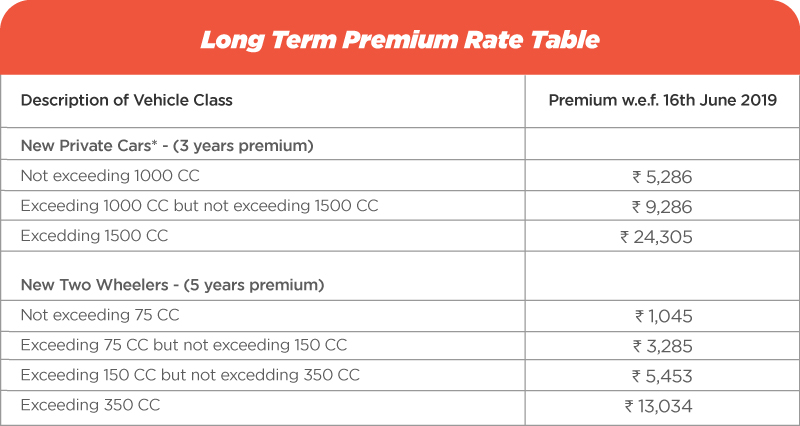

Long term Premium Rate Table

Please see the rates for Long term third party Liability

As a practice, every year, the regulator decides the third party insurance premium that remains the same across all the insurers. The premium is evaluated basis the past claims data of all insurers across different cubic/engine capacity of the vehicle.

Despite increase or decrease in TP premium rates, it is advisable to renew the vehicles before the policy expiry with at least third party insurance. As such, Third party Insurance is mandatory cover as per The Motor Vehicles Act, 1988.

For any further queries, you are requested to contact us on Email: insurancesupport@5nance.com or call us at 022-6713 6720.