Planning to buy an insurance policy? Here’s everything you need to know to maximize your tax savings with insurance policies.

If you are currently on the tax-planning wagon, you must have read and heard over a hundred times that getting an insurance plan can help you save significant amount on tax. So, if you are wondering if you can really avail tax benefits with insurance policies, the answer is ‘Yes’!

How can insurance policies help you in tax-saving?

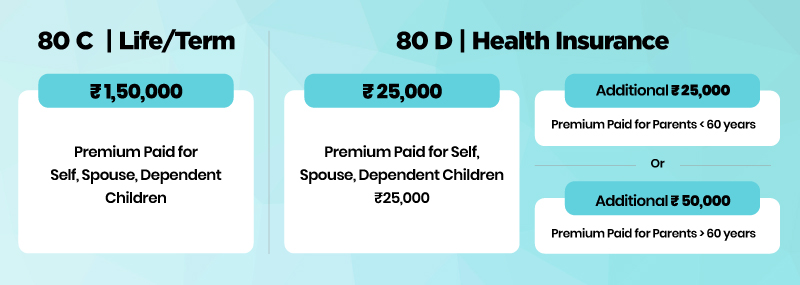

There are special provisions under section 80C and section 80D of the Income Tax Act that allow you to benefit tax deduction for the premium paid on life insurance and health insurance policies. Let’s understand the amount that can be saved under these sections as under:

1.Tax Deduction on Insurance under section 80C:

You can claim tax exemption up to INR 1,50,000/- per annum from the taxable income from various investments and expenses under section 80C, life insurance premium being one of them.

For Example,

Vikram aged 30 years purchased a Term Insurance of 1 Crore for 30 years and pays the premium of Rs. 9,717/- . Vikram can avail tax benefit under section 80 C for the premium amount paid towards the policy.

(Please note: The premium above is calculated for Non-smoker male aged 30 years for HDFC Click 2 Protect 3D plus – Life option as an example)

- Who can claim this benefit?

Individual are eligible to avail tax benefits on life insurance premium under section 80C only if you are the proposer/policyholder or pay the premium with insurable interest towards your spouse, or your dependent children. You cannot claim tax benefit by paying insurance premium for anyone else, so be wary of who you buy insurance for.

- What type of life insurance can help you in tax-saving?

You can avail tax benefits through all life insurance products. However, getting a Term Insurance Plan can be the most beneficial in the long run. Not only it gives you a chance to claim tax exemption, but also offers the lowest premiums with maximum flexibility and additional covers. The Applicable Income tax rules applies as issued from time to time

(Also Read: Factors to consider while choosing the term plan)

2. Tax Deduction on Insurance under section 80D:

Premium paid towards a health insurance or mediclaim for self, spouse, lineally ascendants i.e. Parents and lineally descendants i.e. Children is eligible for tax deduction under section 80 D.

If you have taken riders such as Critical illness under your Term insurance policy, the proportionate amount related to that rider is eligible for tax under this section.

- Who can claim this benefit?

The Proposer/Policyholder who pays for the premium for the above relation is eligible to avail tax benefits

- How much tax can you save on health insurance premium?

You can claim maximum deduction of INR 25,000 if you pay health insurance premium for yourself, your spouse, your dependent children or your parents aged below 60 years. In case, if the parents are senior citizens (above the age of 65 years), then you can avail tax benefit for up to INR 30,000.

Thus, the maximum deduction available under these sections is as under:

(Also Read: 8 factors to consider before buying health insurance)

In conclusion, getting insurance is the easiest way to save taxes while securing yours and your family’s future. However, even if saving tax is your main focus at the moment, do pay attention to other aspects like the right amount of coverage, insurance period, premium amount, and terms and conditions. This will allow you to attain maximum benefit in the long run. For any further clarification or help in choosing the right insurance plan, contact our insurance executives at insurancesupport@5nance.com

Also Read: Common mistakes to avoid while planning your taxes, Get your myths on life insurance cleared