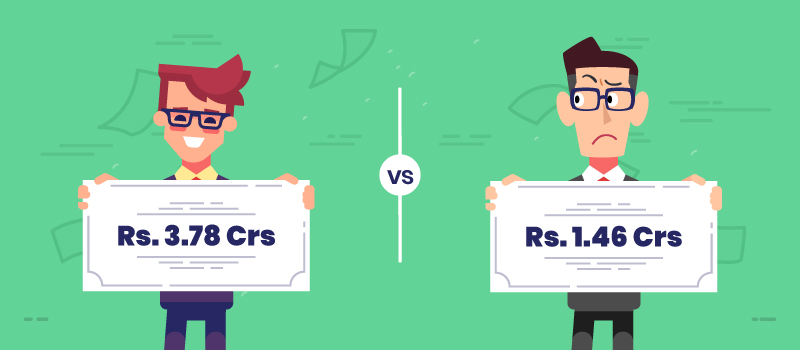

The cost of losing 2.32 crs as your net returns could tie-in directly with not spending enough time on your investment approach & strategy. This loss itself is as much as 158% of the total gain that you would make on your investment. Are you surprised? You might not even know of the loss you are making because of not focusing diligently on your investment strategy. Would you like to know the basis of all this to assess if it’s really the situation with your investments? Here’s sharing with you a case study of 2 investors. It highlights and focuses on the quantum of loss that one makes in an investment opportunity due to an ill-informed approach.

Investor 1: Anil Kumar

Anil works for a Corporate in its Operations function. He is a Chief Manager taking care of key Operation activities. Anil has been someone who has been a very hard working professional all his life. He has been focused on his career, consistently risen up the ranks thereby achieving great heights in his career. At the age of 30, when Anil was married, responsibilities started kicking in. Like all corporate professionals, he took the savvy decision of channelling his savings into smarter investment options. He took the mutual fund route and started investing in SIPs of Rs. 10,000 every month. Today, many of us look at a SIP as a sustainable and safer option for planning to create wealth. He planned smartly for his retirement at 30 by following his uncle’s advice. Investing in SIPs that ‘re spread over 4 schemes totalling Rs. 10,000 for the next 5 years was his next step. Today at the age of 55, he has built a retirement corpus of 1.46 cr. His portfolio has increased at the rate of 15% CAGR from the investments that he made in Mutual Funds. He is quite happy having made close to 1.5 cr for his retirement.

Investor 2 – Sunil Kumar:

Now let’s discuss about Sunil, Anil’s colleague. He is about 53 years old. Quite good in discharging his duties, the only difference is that Sunil is a CA. He too started with his retirement planning at the right time. Being more proactive, he started at the age of 28, before he was married. Sunil being a CA understood the importance of investments earlier. Having sought the services of a professional, he didn’t rely on any family member’s recommendation. He spent a good amount of his time on planning his investments every month. Anil and Sunil earned similar salaries. Like Anil, Sunil too went ahead and made SIP investments of Rs. 10,000 every month. He too chose SIP investments in 4 identified fund schemes for 5 years towards his retirement corpus. The difference in his approach was that he was an active investor, unlike Anil. He would evaluate his investment performance on a monthly basis, seek advice from certified professionals and went on to assessed his investments monthly. Sunil churned his portfolio based on regular performance evaluation over the 25 years that he had held these investments. The net outcome at the age of 53 is that his retirement corpus has grown to 3.78 crs.

Anil and Sunil have been good professionals who invested quite similarly. Both had SIP investments of Rs. 10000 every month for 5 years towards their retirement goals. However, Sunil made 3.78 crs while Anil made 1.46 crs during the same timeframe with a similar value of investments and the same asset class (Mutual Funds in the form of SIPs).

What changed for Sunil? Why did Anil make lesser? What are our learnings from this case study?

1. Sunil’s portfolio grew by 20% CAGR while Anil’s portfolio grew by 15% CAGR. The difference of only 5% CAGR causes such a huge difference over their investment cycle of 25 years. We all make SIP investments; we would do this through our life. Observe the impact of the same asset class delivering very different results because of a 5% CAGR difference in the outcome.

2. Anil relied on his uncle’s while Sunil relied on a certified professional for investment advice.

3. Anil never actively assessed how his investments were doing on a consistent basis. As an active investor, Sunil regularly invested time every month on his portfolio. He understood that investing is not just about putting in the money, but putting in the diligence and time required to sustain and optimise the growth of investments.

Many of us may seek advice from relatives or professionals. It is important to seek professional expertise for all our investments. We work hard to earn our savings, so it’s important to deploy them efficiently. This involves being equally diligent in managing them well and ensuring we make good of the investment opportunities that we have.

With the right investment approach, a 5% CAGR differential may make a whole lot of difference on the outcome of returns, as shared in the case study above.

Would you like to get smarter with your investments? Write to me at dinesh.rohira@5nance.com