The recent COVID-19 Pandemic outbreak has forced us to evaluate standard Practices followed up till now in every area of life. Personal Finance is no different. Captured below are my learnings on what practices need to be changed and how to create Pandemic-Proof Personal Finances.

Lots of pre-COVID-19 activities are to be avoided or not allowed, either for medical reasons or as they are announced illegal by our local governments.

In a similar situation of crisis, during the Peak of WW-II, when the city of London was heavily bombed by the German Forces, the then British Prime Minister in one of his radio speeches to Britain uttered a famous statement, “If you’re going through hell, keep going.” Don’t stop.

As modern citizens of a global world, we are a part of a massive historical change, recording a new normal for ourselves. I have captured a few social events and obligations, undergoing a sea of alterations.

- Working from home- Many companies will utilize this new normal to create & develop online, off-site service delivery mechanisms, giving birth to new business models

- A Big Fat Indian Wedding

- Lots of public festivals-Ganapati, Navratri, Ramzan must either be celebrated in isolation or in limited gatherings

- Dining out, movie & drama inside a theatre is a moment of history

- Importance of CASH or as the saying goes, ‘CASH IS KING’

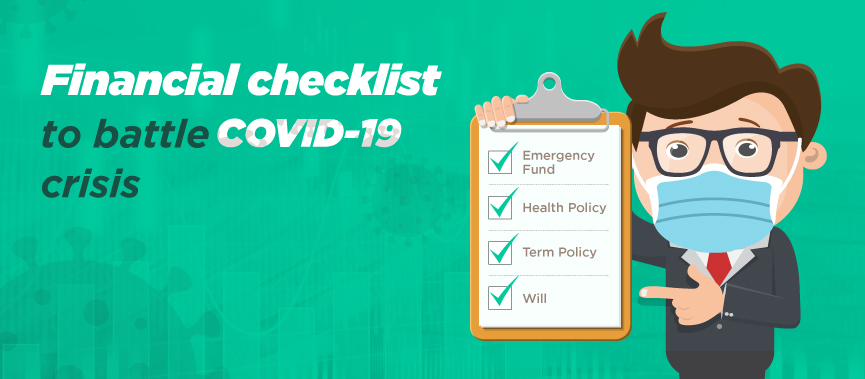

This article tries to capture the old & new (Improved) basic Personal Financial Management Thumb rules.

1. Emergency Fund

Old New (Improved)

3 Months’ monthly expenses in Liquid Funds as Part of your Emergency Fund

Thumb Rules

6 Months’ Monthly expenses as part of your Emergency Fund

Instrument or Asset Class

- Bank Account

- Liquid Fund with Instant-Redemption Option

- FD with Auto-Renewal Option

2. Health Policy

Old New (Improved)

1 Health Policy covering all family members

Thumb Rules

A Forward-looking Health policy which can incorporate the changing health trends in our country (like a Pandemic cover etc)

Instrument or Asset Class

Lot of Insurance Companies in India do provide Health Policies which cover COVID-19 or future Pandemic spreads

Other companies add a small top-up amount to the base policy

3. Term Policy

Old New (Improved)

All earning members of a family

Thumb Rules

Every member of your family including

- The Youngest member

- Mid-age group

- The Oldest member

Instrument or Asset Class

- Highest Cover for the youngest

- Moderate cover with a Top-Up option for the middle-aged

- Moderate Cover for the elderly

4. KYC Updates

Old New (Improved)

All investments including insurance policies had nominees & were maintained electronically in an e-locker

Thumb Rules

All investments- bank accounts, MFs & FD investments

Instrument or Asset Class

Bank Accounts, MFs, FDs, PMS

5. Risk Profile

Old New (Improved)

All investments were based on the individual investor’s profile

Thumb Rules

All investments are based on the age, knowledge of the investor including Market condition-based investments

Instrument or Asset Class

- Age Group: 20-30. Asset class break-up: 90% money in Equities via MFs, 10% money in Long-Term Liquid Funds OR Bank FDs

- Age Group: 30-40. Asset class break-up: 75% of money in Equities via MFs or direct investments. 15% money via Long-Term Liquid Funds, 5% in Gold or Pvt. Equity, 5% in Bank FDs

- Age Group: 50 & above. Asset class break-up: 50% of money in Equities via MFs. 30% money in Long-Term Liquid Funds, Remaining 20% should be in a mix of FDs & Gold

6. Will

Old New (Improved)

Eldest member of the family

Thumb Rules

Every Earning Member of the family

The above suggestions are just broad guidelines to follow. Each individual needs to customize them for their family, keeping in mind their current and future earning potential.

Finally, always remember these WORDS FROM A WISE MAN…

“CHANGE is the most constant thing in life.” The guidelines mentioned above will help you embrace change & progress towards your dreams and goals.