Did you know that you can claim tax deduction benefits up to INR 1.5 lakh? This is applicable for various investments and expenses using section 80C of the Income Tax Act.

It is no new fact that paying your taxes is a part of being a responsible adult. So the question arises, is it selfish to try and save money on your payable taxes? We say, not at all! After all, it is your hard-earned money. But, at the same time, you must follow a responsible approach to save taxes. Luckily, there are several sections under the Income Tax Act that allow you to reduce your taxable income legally. Out of all these, section 80C is the most widely used tax-saving instrument as it can be used to obtain maximum tax deduction benefits.

Why is section 80C considered the best tax-saving instrument?

80C is the only section under the Income Tax Act that allows you to save up to INR 1.5 lakh from your taxable income along with a plethora of other benefits like,

·More than a dozen options to save taxes

·Best options to invest in and earn more than 15% annual returns

·Flexibility to choose tax-saving options between and in combination of:

-Expenses and Investments

-Lock-in period from 3 to 21 years

-Returns from 7 to 15%+

What kind of investments and expenses are eligible for saving tax under section 80C?

Tax Saving Investment Options under section 80C:

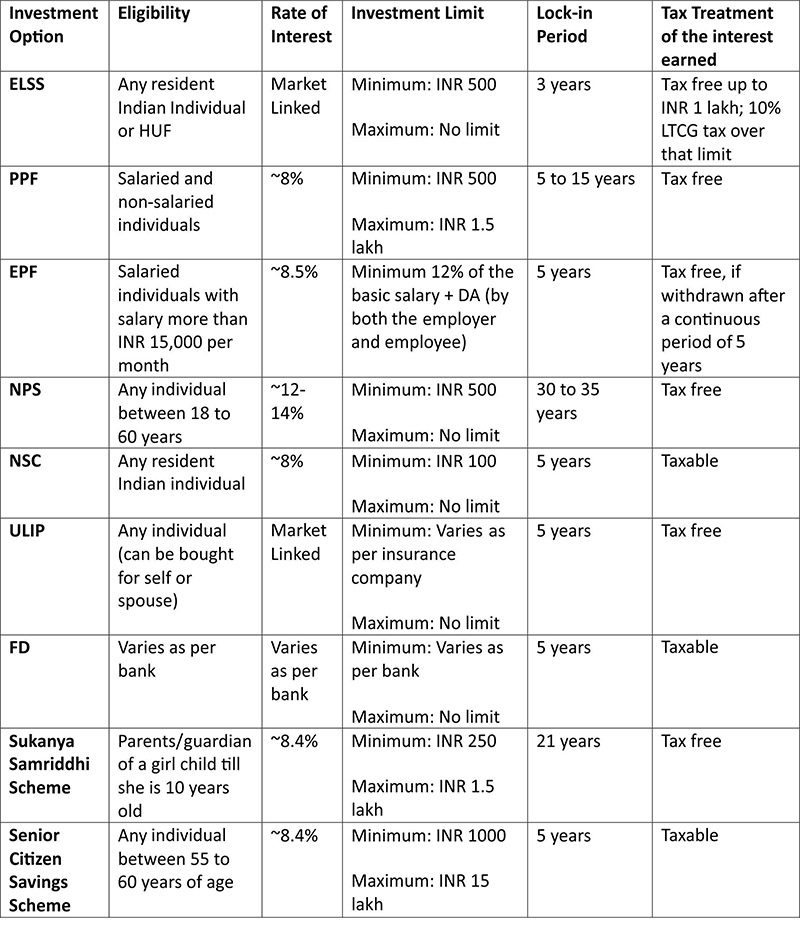

There are several investment options that can be used to deduct tax under section 80C. The best part is that how you want to use these instruments is completely upto your individual financial goals. For example, you can invest in a combination of investment options or you can invest in any one option that you feel particularly confident about. (Read: Avoid these common mistakes people make while investing for tax saving purposes).

Here is a list and comparison of eligible investment options:

Pro Tip: ELSS is the best tax saving investment option available under section 80C

- Shortest Lock-in Period

- Highest ROI

- Returns earned upto INR 1 lakh is tax free

- Option to make small monthly investments

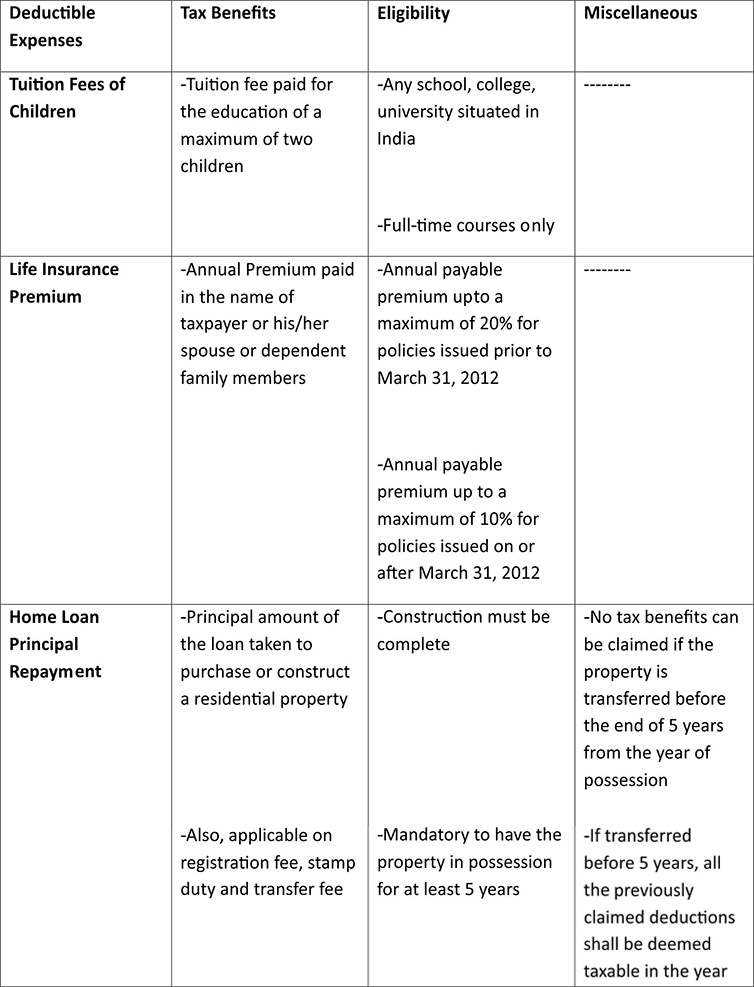

Tax-Saving Expenses under section 80C:

You can also save tax under section 80C by claiming deductions for expenses given in the table below:

Also check: How much can you really save if your tax bracket is 20% and 30%?

Lastly, there is no specific rule as to when and where you should invest your money. However, one thing you must always keep in mind is that the purpose of your investment should not be to save taxes; instead, it should match your long-term financial goals too. In case, you have any queries regarding this point or need help in tax planning, try Tax-Max on 5nance.