How It Works?

on 5nance

amount

portfolio

auto-rebalanced

Why All Rounder?

backed by AI

for 15+ yrs.

Investment

Comparison with Mutual Funds

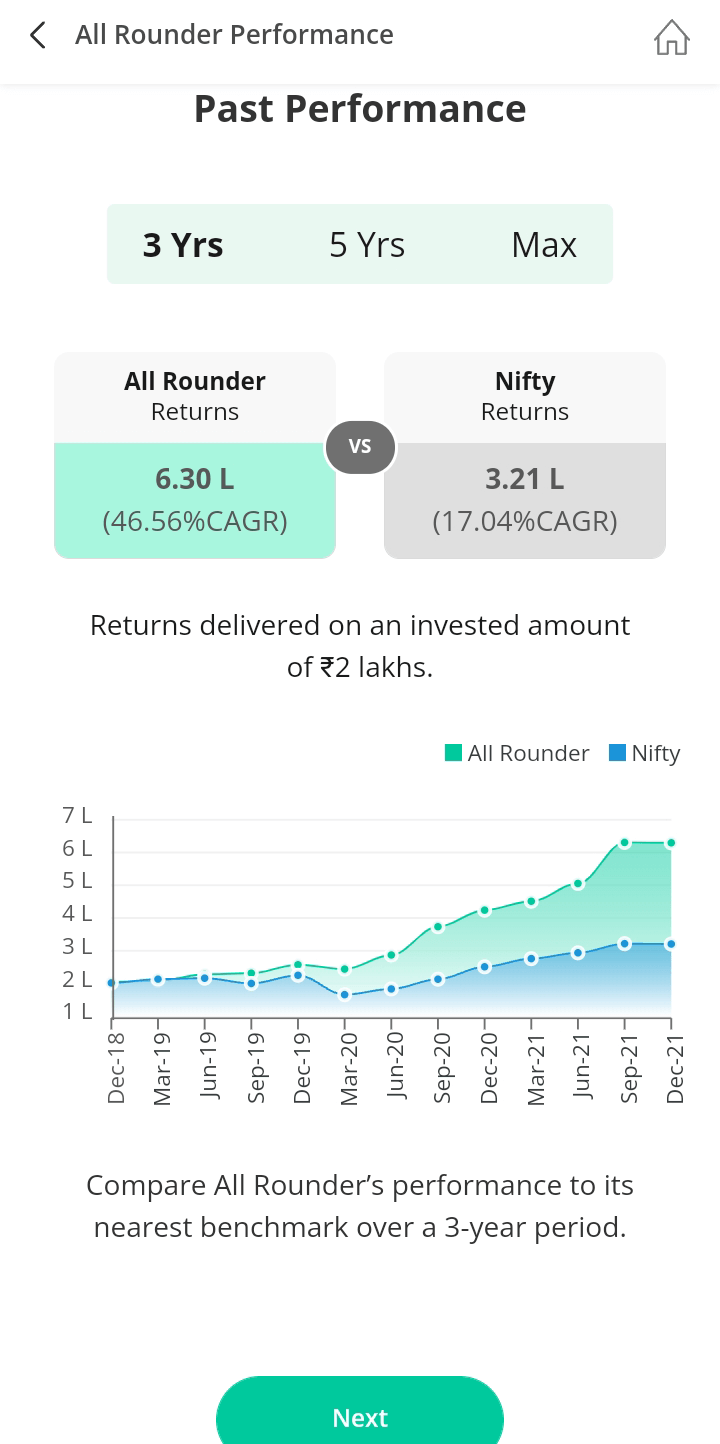

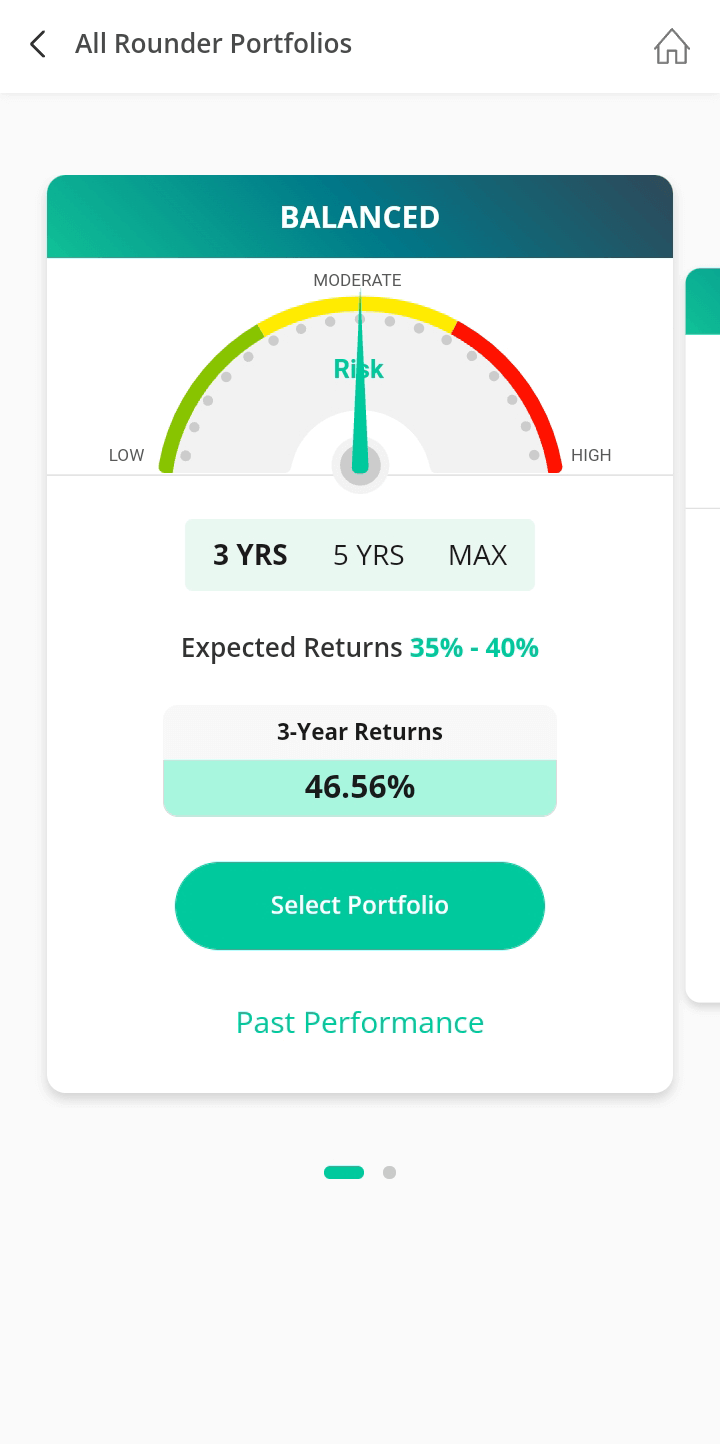

Past Performance

Compare All Rounder’s performance to its nearest benchmark and that of mutual fund schemes over a 3-yr. period.

Advisory Team

With over decades of experience in wealth management, our team is always there to assist you with managing your portfolio.

FAQs

Can't find what you're looking for? Here are some of our most frequently asked questions that can help you out!

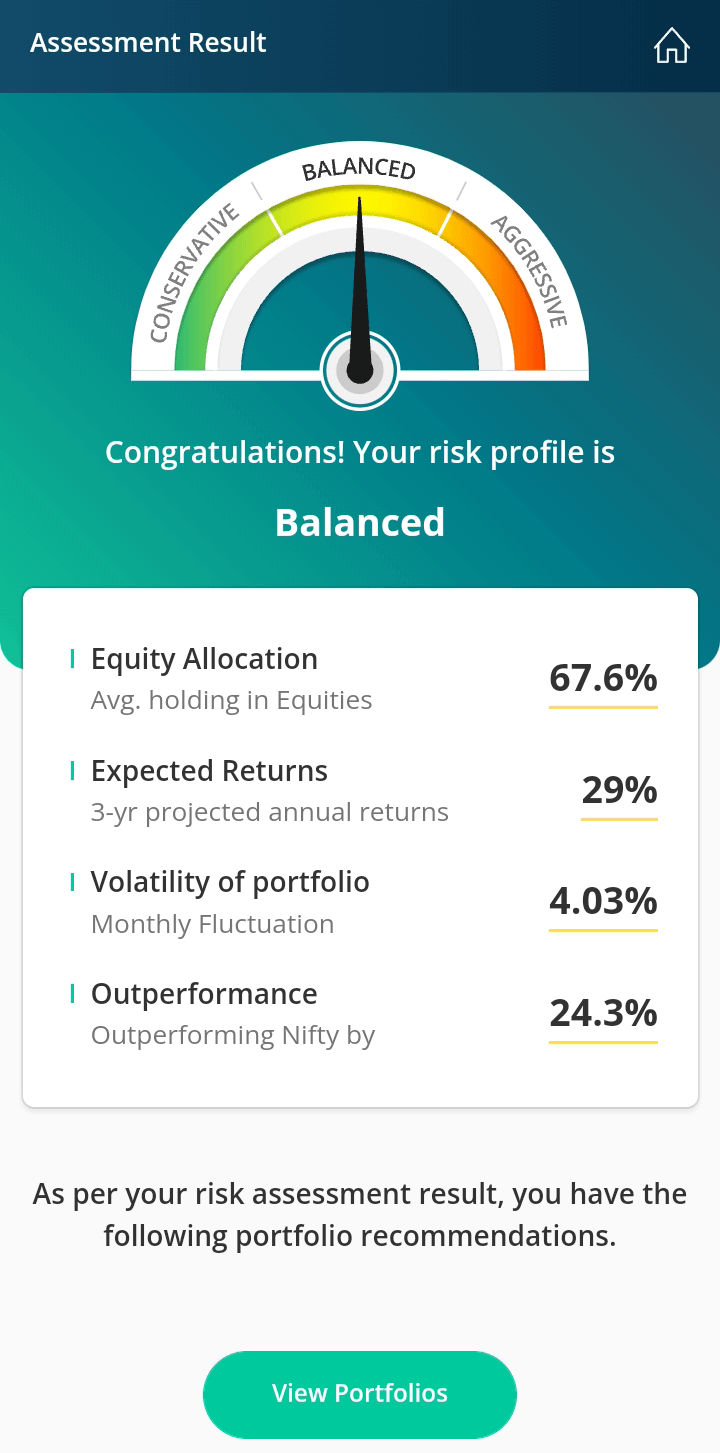

Who should invest?

All Rounder is designed to any investors as profiling determines the suitability in accordance to the investors' risk taking ability. It is an all-weather portfolio which is designed to reduce volatility thereby achieving stable returns on an annual basis. This is the timeframe which FD investors usually invest for. At the same time stocks in the portfolio take care of the growth required to effectively tackle inflation.

Is 5nance.com a stock broker?

5nance is an wealth advisory platform and going forward we will be an Associated Partner with a global broker.

What does 5nance team exactly help me with?

- 5nance helps with curated advisory which is driven by an AI based system which is continuously evolving with practical intelligence. The intention of this advice is to maxmise investment returns to achieve consistent returns with minimal non-leveraged risk.

Do I need to have a demat and trading account to subscribe to the services offered by 5nance?

To execute the advice provided it is essential to invest into stocks and ETFs which can be bought and held in a demat account.

Why does 5nance charge an advisory fee?

The advisory fee is charged so that the built systems and technology can be made more robust and future proof so that 5nance can continue to provide optimised services to achieve high performance.

Who manages advisory?

The research team works very closely with the technology team to build and maintain systems to optimise and improve investment portfolio performance.

What is the investment philosophy of 5nance?

The investment philosophy is an ever-evolving philosophy focussed on future growth. Being a technology company ourselves, our ethos is also driven by investing into the future be it for investor portfolios or even when it is for our team and processes.

What parameters are used to create the model?

The model begins with early warning signals which takes in consideration a whole host of global and India specific macro-economic parameters. When securities are chosen, parameters like sustainability, management quality, unit economic analysis and many others are quantified to bring to the fore high caliber securities. These are again analysed with the price action theory. The above parameters are also under continuous incremental transition and evolution.

What is minimum and maximum Investment amount?

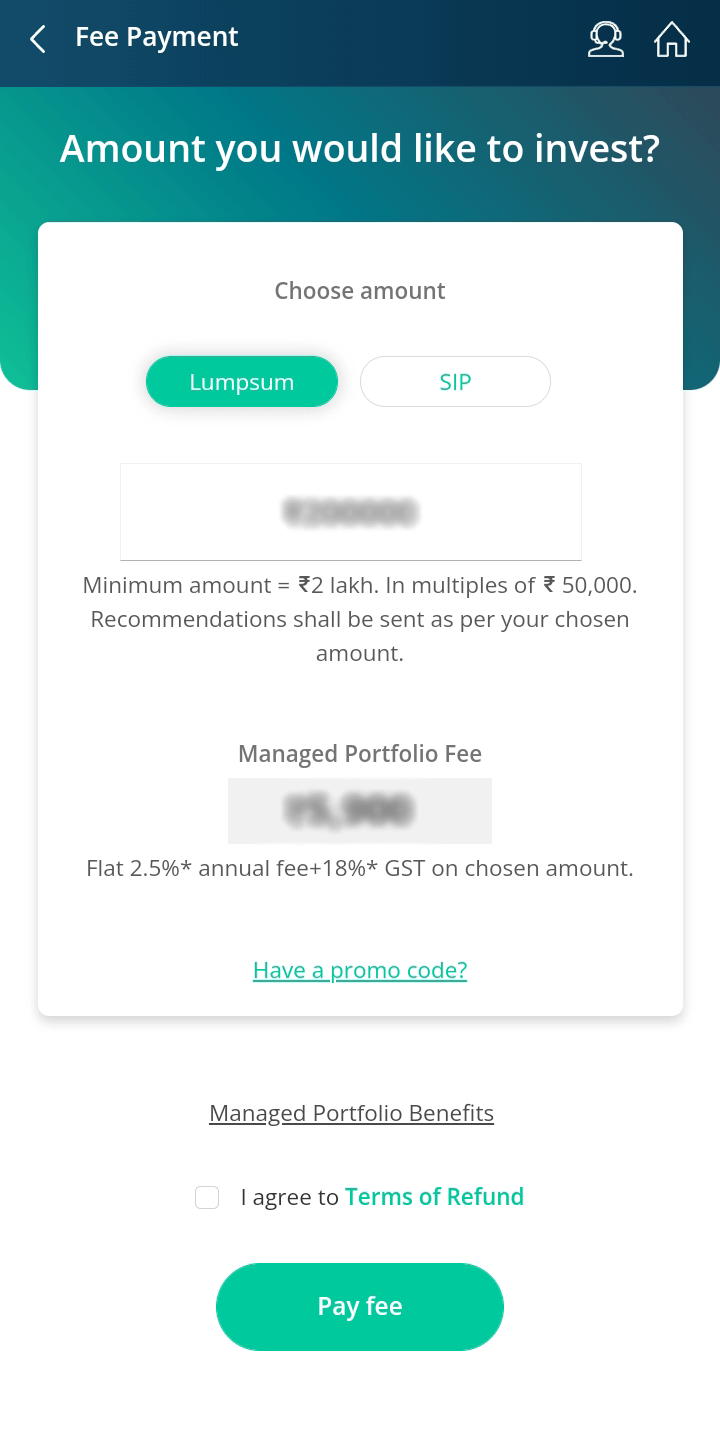

There is no such requirement. Though for execution services a minimum investment of Rs. 200,000 is required which is also ideal.

It is a fee based investment?

- We charge a flat fee of Rs 7500/- on Advisory Model and 2.5% on Execution model on the portfolio amount. (Taxes applicable)

Tenure of the structure?

There is no lock-in period. We recommend to stay invested for 3 years to get optimal results.

What happens in case of underperformance?

There could be periods when All Rounder underperforms important indexes. That is when we track, take stock and course correct. In recent years there has been an underperformance of a maximum of 3 consecutive months.

How much minimum returns I can expect from this product?

- Over the investment period of 3 years you can expect consistent returns.

What happens when markets are negative?

The product is designed to protect during market downturns. This is achieved by investment in high calibre securities and prompt shifts in asset allocation to have a sophisticated hedged portfolio.

Is there any extra/ hidden cost in this?

This product has no hidden fees.

Tax implication of this product?

Usually the holding period is more than a year. Therefore a 10% long term capital gains tax is applicable. Only in a few cases short term capital gains tax of 15% will have to be paid.

Key features of this product?

It is an absolute return product and the two main features of the product's core are:

Where you will invest?

There are stocks and ETFs that can be bought and held in the demat account. For risk-off investments ETFs can be held while stocks can cover the growth requirements.

Can I carry out transactions, other than the ones recommended by 5nance, on the Upstox/Zerodha Platform?

Yes, it can be executed with any broker. Once we begin execution with our associated broker this leg will become even more seamless.

Will a robot manage my investments/advisory? Or there is a human interference.

The research carried out to provide advisory is automated to a large extent and so is the entire process that follows. Though every now and then, a human touch is required to only improve the experience and performance.

Why you should invest?

Markets will stay volatile and investors have a rationale requirement of safeguarding the money and flexibility when the markets are low and gaining higher returns when the markets are high. Our algorithm does this accurately to ensure that you gain positive returns irrespective of the market conditions.

Do you guarantee a return on my investment?

No investment can have guarantees, not even government bonds. Though the portfolio is well diversified with multiple asset classes, the risk is prudently managed.

Can I choose not to act on a notification if I have a different view on the stock?

Always it is the investor's discretion whether they want to act or not. We provide our advisory basis the entire portfolio, hence many a times a particular stock or ETF might not look lucrative on its own but is very relevant in context of the entire portfolio.

Can I make changes to my portfolio if I have a different view on a stock?

Yes like said previously, the control and ownership lies with the investor.

What happens if I miss the mail or the notification?

We provide multiple reminders and because it is not trades but investments, price fluctuations in a few days can have little impact on a portfolio investment horizon of 3 years.

What happens if I still am not able to execute the transaction?

It will be rebalanced in the next advisory. Besides our individual securities are of very high calibre and less often are impacted by timing.

Will the funds be re-deployed post triggering of Stop-Loss or Position Sizing?

Not applicable, as we are not a trading based advisory platform.

It will deliver negative return?

On a yearly basis it has never delivered negative returns, not even in tough years. It is designed to optimally allocate to assets considering the overall portfolio situation. Though there can be times that all assets classes are in a downward spiral and the product does not deliver for a year.

Can I exit before 3 years?

Yes. These investments have no lock-in period, though advisory and execution to stay ahead will be stopped.

Will I be getting daily trading calls?

All Rounder is an offering with an investment mindset to enable growth generation with little risk. Therefore it is not a run of the mill trading advisory with targets and stop loss. Rather it is a portfolio management which has intentions to build wealth. It takes care of the growth required for financial independence.

Is there a schedule to pay the monthly subscription fees?

The advisory fee is charged on an annual basis.

How it works?

- We have sophisticated systems and processes to build an all-weather portfolio. These portfolio suggestions need to be followed and approved to achieve the best results. The portfolio holdings include risk-off assets and stocks to achieve the growth factor. The objective is to achieve consistent annual returns.

Can I transfer my existing folio in this structure?

No an existing folio cannot be incorporated.

Can I continue the structure after 3 years?

Yes you can.

Will I get regular update of my investment?

Yes the update will be on a monthly basis.

AR Investment v/s PMS

All Rounder is more DIY and also the investments are held in the investor's own demat account rather than a pool account. In PMS the advantage is that after the funds are transferred the investor can just sit back but the that also means that an investor has very little control.

How much do I need to invest?

It is advised that atleast a lakh of rupees can be set aside for investment to have a meaningful portfolio.

How do I access the transaction details?

Each day when transactions take place, a contract note will be emailed after which transactions in the demat account will also be sent across.

How can I view my Holdings?

All trading and broking accounts have a section which mentions the Holdings. Besides consolidated Holdings statements are also provided by the depositories.

How often will my portfolio be reviewed?

The portfolio is reviewed on a weekly basis but it not necessarily mean that action needs to be taken that often. Our experience has been that action on individual securrities need to be taken twice a month.

How can I sell my portfolio in case I need the money ?

As the control, ownership and access lies with the investor. One only needs to see their holdings and put sell orders to get access to funds in 2 days.

How will the Risk Management System be executed / implemented on my portfolio?

The RMS is ingrained by a well diversified portfolio with high calibre securities. Also the agility of systems enables prompt shifts in asset allocation. Both of the above are administered by a 3-layer analytical system with a strong tracking mechanism.

What is Cash Allocation in my Portfolio?

Cash allocation is just to create a buffer to account for the changes in price and other expenses like demat charges, brokerage, CDSL charges etc.

How will I get over 30% annual returns?

The objective is to get consistent returns on the capital over a 3-year time frame. An AI-driven, dynamic asset allocation hedges against the risk from the downside when equities fall. AI-driven price action defines the tactical allocation and security weights too. Also, the portfolio is curated with high-quality securities that are in a favorable position to generate alpha over the frontal indices across various cycles.

Can I add one more stocks to my All Rounder Portfolio?

Yes. The control & ownership lies with the investor. We provide our advisory basis the entire portfolio. So for proper Portfolio execution, tracking & management, it’s recommended to add only 5nance’s suggested stocks to your All Rounder Portfolio. 5nance will track & review only its recommended stocks in your All Rounder Portfolio.

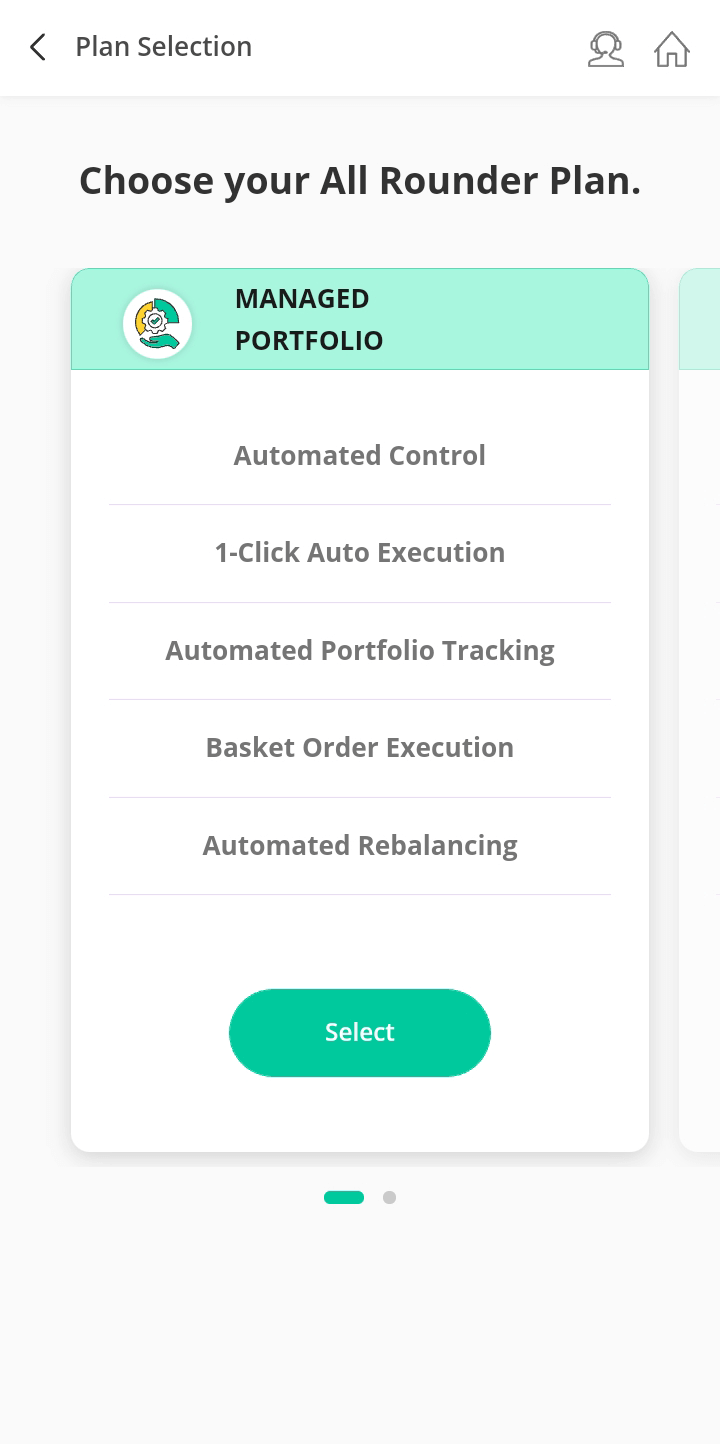

Why should I opt for a managed portfolio?

A managed portfolio works with a single-click consent when rebalancing is scheduled. Hence, it reduces your effort while also improving accuracy to provide better results. Moreover, the trading process is hassle-free.

What is the difference between an advisory and a managed portfolio?

|

Advisory Portfolio |

Managed Portfolio |

|

Self - Driven |

Automated Control |

|

Do It Yourself |

1-Click Auto Execution |

|

Manual Portfolio Tracking |

Automated Portfolio Tracking |

|

Single-Trade Execution |

Basket Order Execution |

|

Rebalancing Updates |

Automated Rebalancing |

What is POA?

When you sell shares during market hours, the shares are debited from your (seller’s) account to deliver to the buyer. The broker needs the Power of Attorney (POA) to debit these shares from your demat account.

What is TPIN? How to generate CDSL TPIN?

TPIN will be generated by broker (zerodha). You would have received the CDSL TPIN to your registered mobile number and email address with CDSL ). You have to use the CDSL TPIN instead of your Kite PIN, and authorize the stocks to be debited from your demat account before placing a delivery/CNC (including GTT) sell order on Kite.

What is a TOTP w.r.t Zerodha? What is the process?

TOTP means a Time-Based OTP. It’s a one-time task that adds security to your demat account. It is a two-factor authentication process for your demat account.

How will I add funds? Where will I add my funds?

You cannot add funds through the 5nance platform. You need to add funds into your brokers trading/demat account via UPI apps, Net banking, IMPS, NEFT or RTGS & via a cheque.

What do I do when I don’t have a Trading/Demat account?

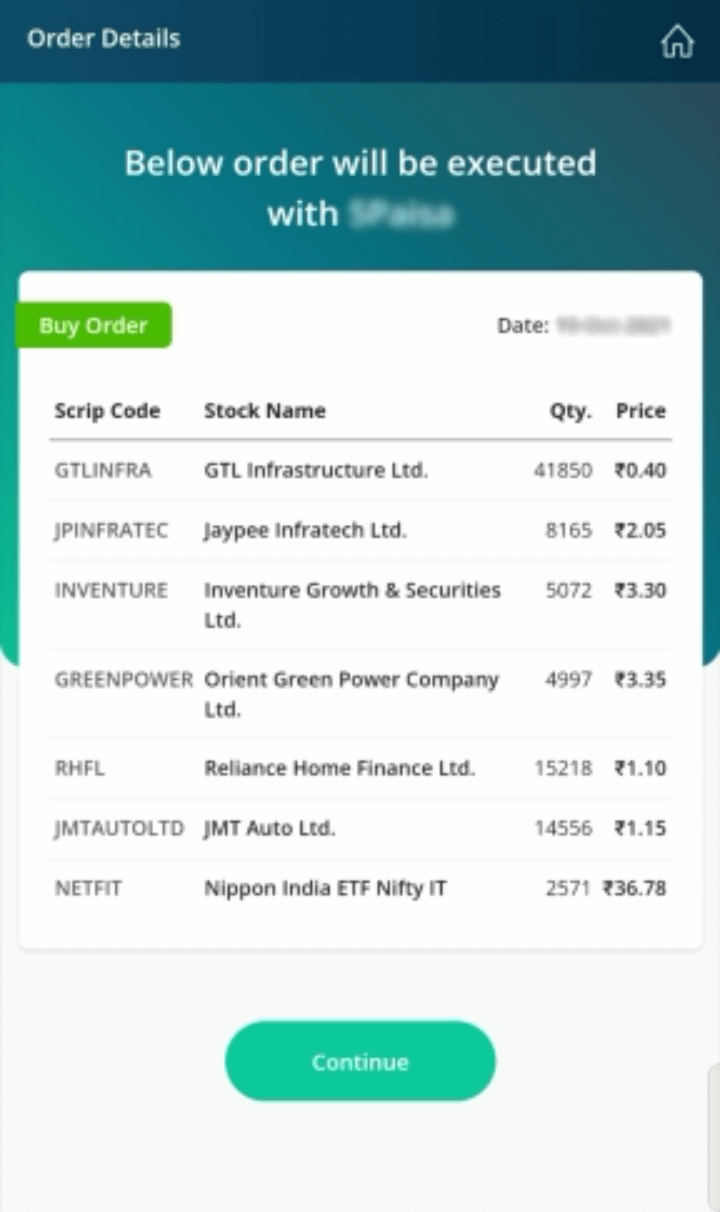

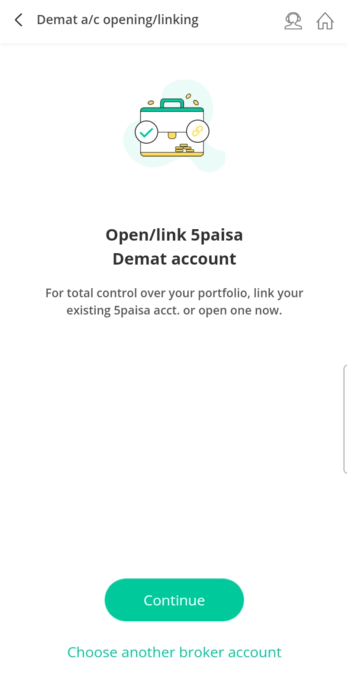

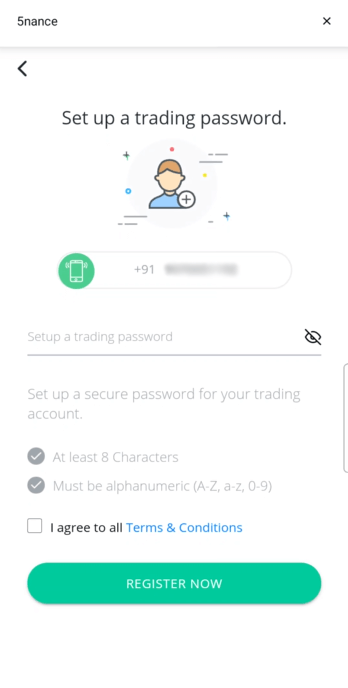

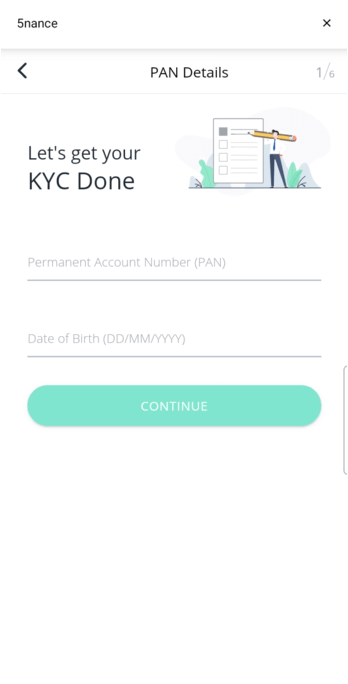

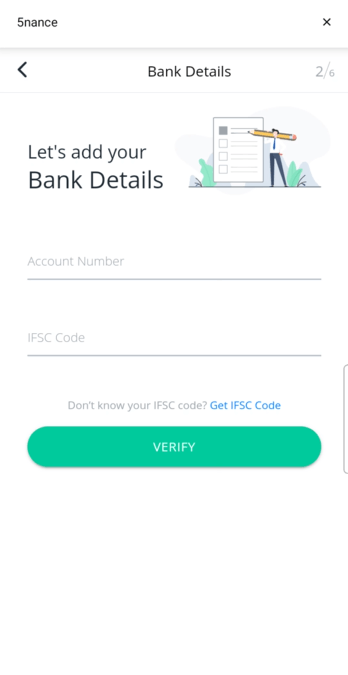

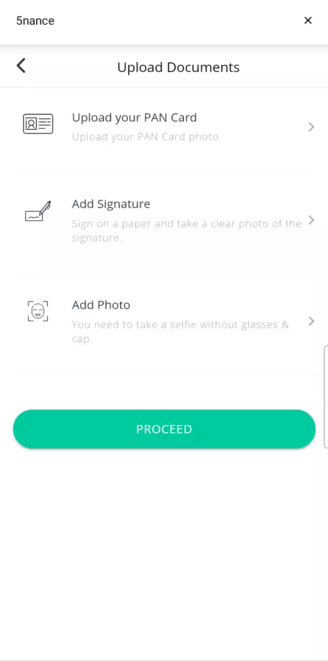

- Open a new trading/demat account with the broker 5paisa.com utilizing the 5nance platform (screenshots) – Steps details required

- Click continue on Open/Link 5paisa demat account

- Set up trading password

- Fill up your personal details – PAN no. & birth date

- Add your Bank details – a/c no & IFSC code

- Upload the documents – PAN card, Signature & Photo

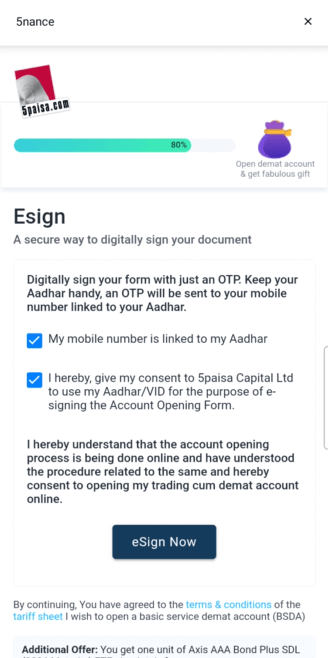

- e-sign the form digitally using your Aadhaar card

- The application process will be completed & account will open in the next few hours

- Open a new trading/demat account with 5nance’s broker partners - Angel One, Zerodha etc.

- Documents you need to open a new trading/demat account – i)A photocopy of the PAN card ii)Aadhaar card details iii)mobile number linked to your Aadhaar card iv)Bank proof v) Income proof

What documents are required to open a Trading/Demat account?

The following documents are needed to open a Trading/demat account

- A photocopy of your PAN card

- Aadhaar card details

- The mobile number linked to your Aadhaar card

- Bank proof: A cancelled Cheque/ Bank statement/Passbook front page

- Income proof – Bank statement for the last 6 months/ the latest salary slip

- Signature – A photo copy or scanned copy of your signature to be uploaded

How can I change my risk profile?

You cannot change it. The risk profiling window will open after 6 months. It’s regulatory in nature as the advisory gets aligned to the risk profile.

What if my phone number is not linked to the Aadhaar Card?

- Visit the nearest Aadhaar centre & update your mobile number with the Aadhaar card

- Request for an offline agreement on allrounder@5nance.com It can be couriered to 5nance.com (Innovage Fintech Pvt. Ltd) A-703, Eureka Towers, Mindspace, Malad West 400064

What documents are required for account opening

Complete the KYC process using your PAN Card & Aadhaar Number.

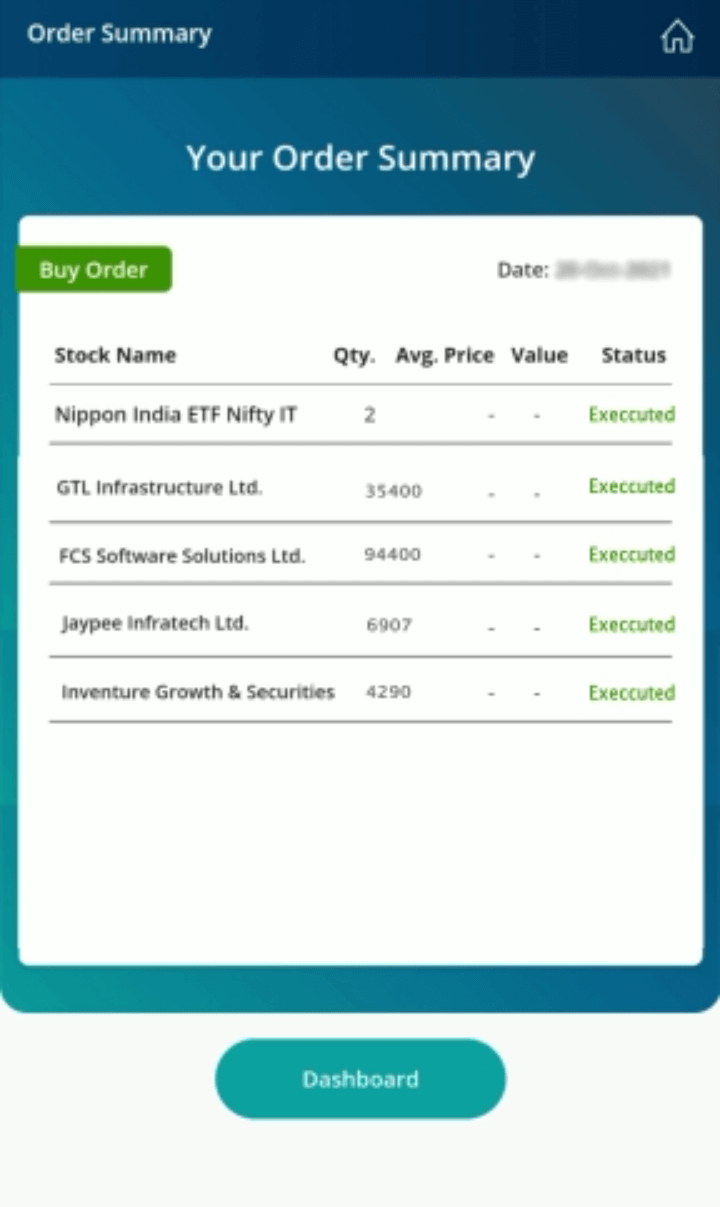

My order was executed. But was it executed as a partial order?

The order is normally placed as a market order. 99% of the time, it gets fully executed.Although, it may happen that order gets executed partially. In such a case, a differential quantity will be available for execution in the next 30 minutes on the platform.

Can I put after-market hours through 5nance?

No, the aftermarket hours' order can not input through 5nance.

Haven’t received any update on my order?

On execution of order, the same will reflects within 5 minutes in the 5nance App under your dashboard. In case the order is failed or rejected, the same will be available again in 5nance site in next 30 minutes for execution.

My order failed, how will I execute it?

In case your initial order is failed, kindly check the reason of failure in your broker account and take corrective action. The order will be available again at 5nance site in next 30 minutes for execution.

Can I get a discount on renewal fee If I pay in advance?

There is no any discount or offer on advance renewal fee. You need to pay complete subscription charges as per the selected portfolio.

Do I have pay any additional fee for renewing the services?

No, you do not have to pay any additional fee for renewing the services. You have to pay only the subscription amount as per the portfolio selection.

Will my subscription get automatically renewed?

You will get subscription renewal notification with renewal link via email, WhatsApp and in app notification. You need to click that link and need to pay the fees as per the portfolio selected.

What about my capital gains, is there a report?

There will be a provisional report from us on the capital gains. Actual capital gain report needs to be collected only where the shares are held i.e. from the stock broker

Will I get my P&L Statement?

P/L statement is issued by the brokers. We have the provision to see the entire trade book.

Will I receive any report on my portfolio?

There will be a performance report shared on a monthly/quarterly basis

How will I get any communication on Rebalancing or updates?

We providing multiple reminders via app notifications, SMS, emailers & WhatsApp messages.

How can I track my portfolio performance?

Our platforms available on web and app. Additionally we shall be sharing the performance update with you each month.

Are there any hidden charges or charges over & above advisory fees?

This product has no hidden fees. We only charge advisory fee as per your plan and investment amount for All Rounder product, apart from same, there is absolutely no charges from 5nance.

How much brokerage is charged on the trades?

We do not charge customers any brokerage or commission for execution of transactions. Any brokerage/commission levied to the customer will be as per his arrangement with the broker that he is executing the trades with.

What are the charges for Top-up?

Rule 1:

Minimum fees on Lumpsum & SIP amounts will be INR 100.

Rule 2:

Fees will be charged for a minimum of 2 months throughout the year of the execution services availed by the client. The exception is Rule 3.

Rule 3:

No top-up will be allowed in the last month of the service period.

Here ‘Service period’ or ‘Service’ means 1 year from the date of availing the execution services.

We’ll charge fees of 2.5% per annum as and when the above-mentioned 3 rules are fulfilled.

The calculation will be done for the remaining period divided by 2. The fees shall be charged for the 2 months’ rounded off.

| Remaining months | To be charged for (Months) |

| 12 | 12 |

| 11 | 12 |

| 10 | 10 |

| 9 | 10 |

| 8 | 8 |

| 7 | 8 |

| 6 | 6 |

| 5 | 6 |

| 4 | 4 |

| 3 | 4 |

| 2 | 2 |

| 1 | 0 |

No fees to be charged in the last month. The fees will be charged on a pro-rata basis.

What is the Fee structure for a Managed Portfolio (Lumpsum/SIP)?

- Fee structure for a Managed Portfolio: Lumpsum – 2.5% of the total portfolio amount + 18%* GST

- Fee structure for a Managed Portfolio-SIP

| Monthly SIP amount in Rs. | Fee Structure in Rs. |

| 10,000 – 12,000 | 3500 + 18%* GST |

| 13,000 & onwards | 2.5% of the total portfolio amount + 18%* GST |

What are the fees charged for Advisory-Lumpsum/SIP?

We’re charging a flat fee of Rs.7500/- + 18%* GST on irrespective of the amount for Advisory services - Lumpsum and SIP.

How will I get my SIP portfolio updates?

We are providing multiple reminders via app notifications, SMS, emailers & WhatsApp messages. You can also check them on your All Rounder Dashboard.

What is the min and max amount of SIP?

Start a SIP in All Rounder with a minimum amount of Rs. 10,000/- per month. You can add amount in multiples of Rs. 1,000/-.

Portfolio recommendations will be sent as per your chosen SIP amount.

Can I choose/change my SIP date?

No. You cannot change your All Rounder SIP date. The SIP date for each month is the same as the date of your first month’s subscription.

What will be the min. SIP amount?

You can start an SIP in All Rounder with a minimum amount of Rs. 10,000/- per month.

Will I get to know the reason/rationale behind rebalancing?

Yes. For securities that need to be bought afresh or sold completely, there will be a rationale for same.

What if I missed rebalancing update?

We providing multiple reminders via app notifications, SMS, emailers & WhatsApp messages. As it is not trades but investments, price fluctuations every few days can have little impact on a portfolio with an investment horizon of 3 years.

What is the frequency of getting rebalancing updates in a month?

On an average, rebalancing is done once in a month. Rebalancing could be done 2-3 times in a single month. There could be no rebalancing done for 2 months at a stretch. It totally depends on the market conditions and stocks in your portfolio.

How can we assure 100% capital preservation during a correction?

The product is designed to protect your investment during market downturns. This is achieved by investing in high-caliber securities and prompt asset allocation for a sophisticated hedged portfolio.

Is All Rounder a tax-saving investment?

No. All Rounder is not a tax-saving investment. Usually, the holding period is more than a year. Therefore, a 10% long-term capital gains tax is applicable. Only in a few cases will a short-term capital gains of 15% require to be paid.

How is Artificial Intelligence used?

Artificial intelligence is used to define asset allocation, stock weights and to identify the price action for a large set of securities. There are regular checks as well to review the AI's output.

Is there any lock-in period for this product?

No. There is no lock-in period. All Rounder is long-term investment Product.

So to get ~2x returns, we suggest staying invested in All Rounder for atleast 3 yrs.

Can I get a review done for all my stocks that are not a part of All Rounder?

You’ll get reviews only on the stocks that are a part of your All Rounder portfolio.

What is Risk-Off Allocation?

These assets are negatively correlated with equities. They protect the downside when the equity markets fall.

Can I execute a partial order?

Yes. It’s always the investor's discretion whether they want to go ahead with the recommended stocks or not. We provide our advisory basis the entire portfolio. Often, a particular stock or ETF might not look lucrative on its own. But it is very relevant in context of the entire portfolio.

Will I get the returns monthly?

Although returns are tracked daily, it’s best to track your portfolio’s performance over a quarterly basis. Our experts recommend that you stay invested for at least 3 yrs. to ensure your portfolio’s optimal performance

Agreement says - Fees charged is only for 6 months, remaining is as complimentary services, in that case will this be the same for every consecutive year or it is only for the Initial year and it will keep on changing year on year?

This is complimentary offer only for first year and the fee charges may vary year on year.

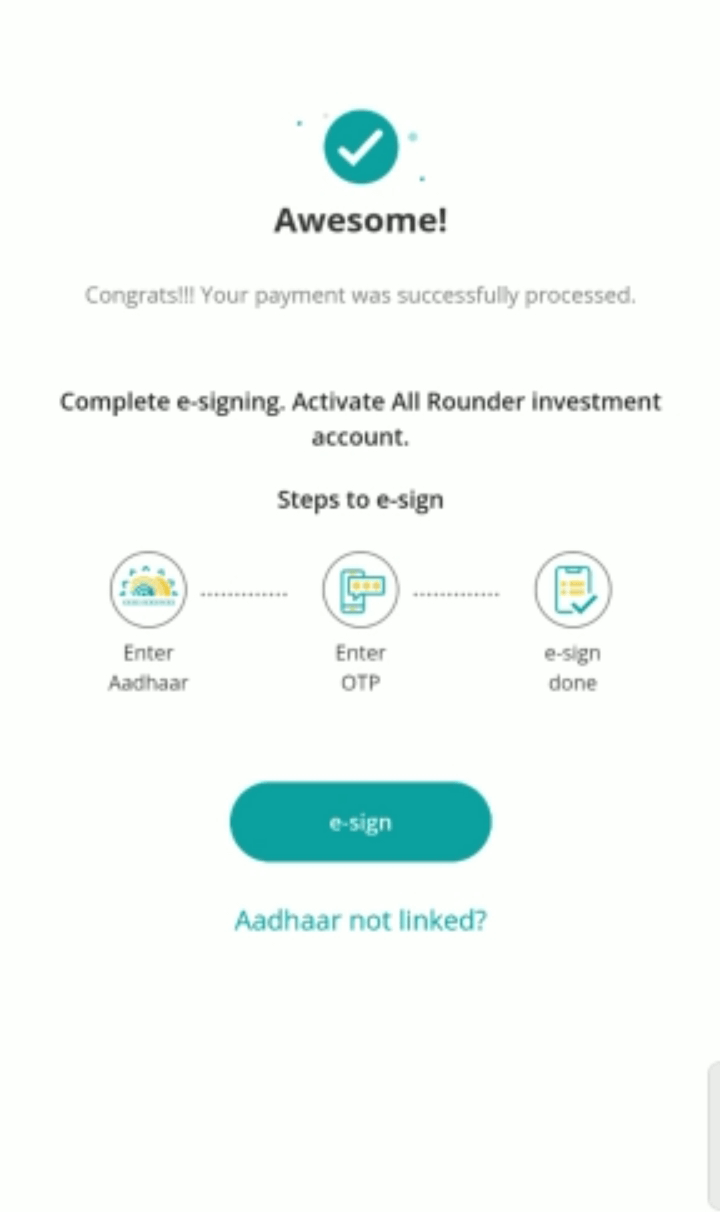

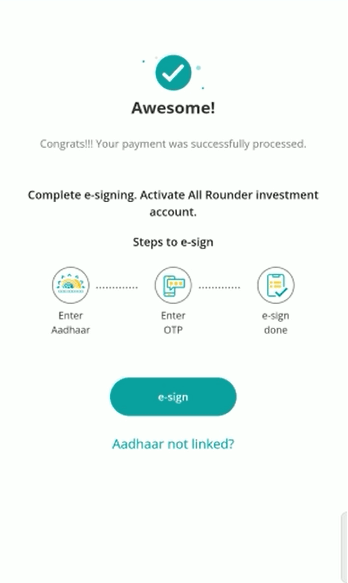

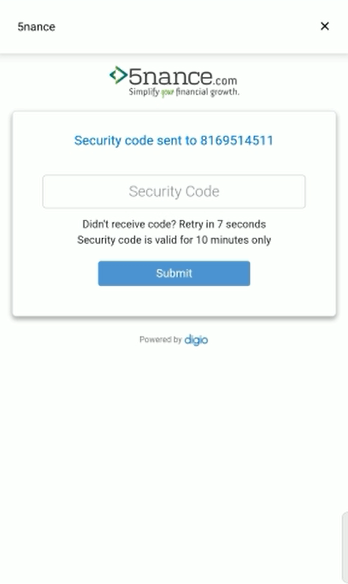

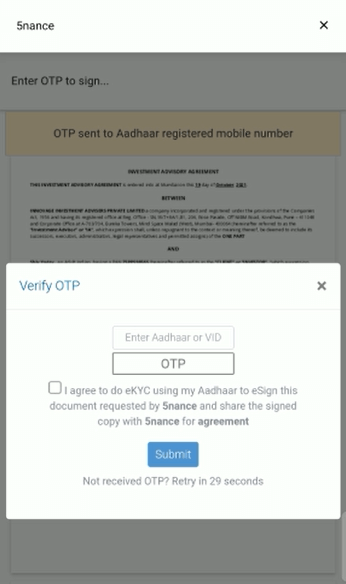

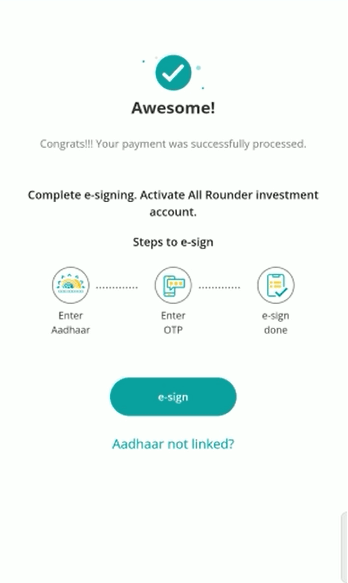

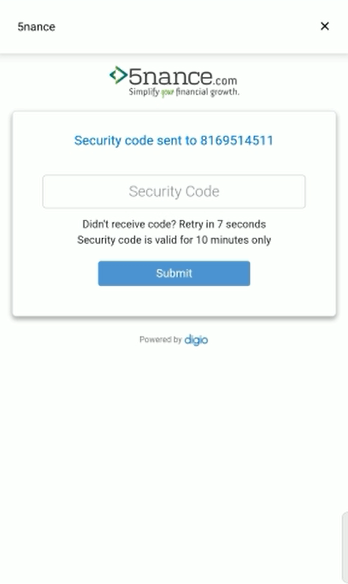

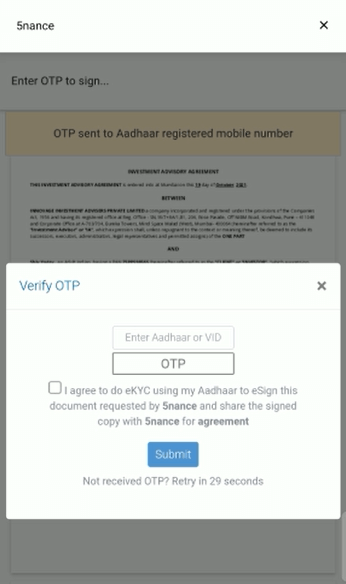

How do I e-sign?

Once the payment is successful, activate the account by e-signing

- A security code will be sent to your mobile number (registered with 5nance)

- Enter the Aadhaar card number

- Enter the OTP sent on the mobile (that is linked with the Aadhaar card)

- E-signing is done.

How do I e-sign?

Once the payment is successful, activate the account by e-signing

- A security code will be sent to your mobile number (registered with 5nance)

- Enter the Aadhaar card number

- Enter the OTP sent on the mobile (that is linked with the Aadhaar card)

- E-signing is done.

How can I proceed when my broker is not available on 5nance?

- Since 5nance has tied up with 5paisa.com you can open a new broker account with 5paisa via the 5nance platform. Simply follow these steps

Steps to open a broker account via 5nance:

- Click continue on Open/Link 5paisa demat account

- Set up a trading password

- Fill up your personal details – PAN no. & birth date

- Add your bank details – a/c no & IFSC code

- Upload the documents – PAN card, Signature & Photo

- e-sign the form digitally using your Aadhaar card

- The application process will be completed & account will open in the next few hours

How can I open an account with All Rounder?

- Existing 5nance customer - Log into the 5nance app / If you’re a new customer – register with 5nance

- Click on the All Rounder home page banner in Our Best Offerings section

- You will see the All Rounder Video & its USPs

- Check All Rounder’s past performance

- Choose your All Rounder Plan – Managed portfolio or Advisory portfolio

- Determine your capacity to take risk (Risk profiling)

- Choose investment amount

- Complete the e-signing process

- Open/Link your demat account

- Automate portfolio execution with consent